About us

Co-operative & Community Finance is the trading name of the ICOF family of businesses.

Industrial Common Ownership Finance Ltd trading as Co-op & Community Finance was set up in 1973 and has since created a number of related funds, all of which are democratically owned and controlled by the members. For over 50 years, CCF has supported hundreds of borrowers ranging from small community-run enterprises to large award-winning organisations. Through the provision of accessible finance, the CCF team has helped to create and preserve thousands of jobs within the co-operative economy and supported the set-up and growth of many innovative co-operatives, employee-owned businesses and community enterprises.

OUR VISION

“A thriving, diverse and sustainable UK co-operative economy with ready access to capital.”

OUR MISSION

“To make the right finance available, at the right time, for co-operative enterprises in the UK.”

Our values

Our values align with and are inspired by the seven co-operative principles and international cooperative values.

-

Principled – we set high standards for ourselves and are committed to improving equality, diversity and inclusion across all the work that we do

-

Credible – we are honest, fair and transparent and act with integrity and compassion towards everyone we deal with

-

Supportive – we work in solidarity with the co-op sector to help the co-ops and enterprises we work with to overcome challenging times and celebrate successes

-

Collaborative – we work alongside partners and share our knowledge and expertise to support the growth of the sector

-

Flexible – we are dynamic and nimble, embracing changes and opportunities arising within the sector.

Our strategic objectives

-

To diversify and optimise revenue streams – to ensure the long term viability and stability of CCF we will ensure we have diversity across our revenue streams and optimise opportunities that align with our vision, mission and values.

-

To raise new finance – to maintain sufficient finance for lending and investment to meet our mission, we will raise new finance through community shares and investments in accordance with our ethical policy.

-

To offer the right finance with wider reach – to provide appropriate loans and investments to co-oper- atives across the UK, we will offer a tailored range of products to the sector and reach into all geographic areas of the UK and market segments.

-

To harness innovation through partnerships – to maintain and develop new partnership products and services and broaden our reach, we will actively seek opportunities to work with partners and stakeholders to design and deliver innovative products and finance packages that support our mission.

-

To be socially responsible and ethical – to continue our commitment to our Equality, Diversity and Inclusion action plan, we will support efforts to tackle climate change and social justice and challenge where appropriate to maintain our values.

Structure & governance

Structure and membership

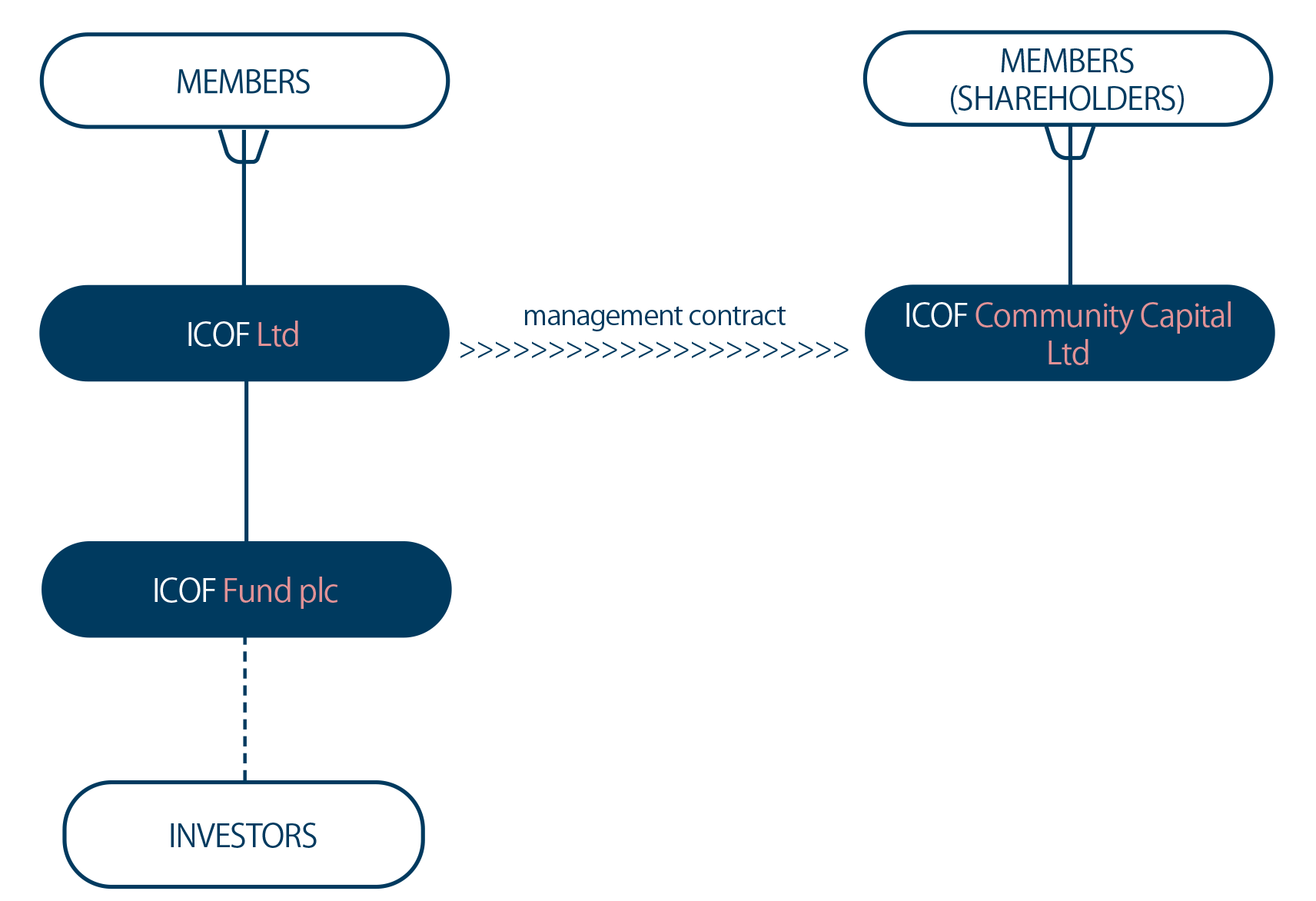

Co-operative & Community Finance is the trading name of ICOF Ltd which has a subsidiary, Industrial Common Ownership Fund plc (ICO Fund plc). ICOF Community Capital Ltd (Community Capital) is a free-standing community benefit society for which ICOF acts as fund manager.

Membership of ICOF Ltd is open to any individual or organisation who supports our aims and who pays a one-off membership fee (currently £30). All our borrowers automatically become members. Follow this link to apply for membership.

Membership of Community Capital is open to individuals or organisations who have bought shares in the society. The minimum investment is currently £250. Follow this link to invest in Community Capital.

Management and accountability

ICOF Ltd is the only one of the organisations to employ staff. ICOF Ltd directly manages the business of its subsidiary and is contracted to manage Community Capital. ICOF Ltd can do this because it is authorised and regulated by the Financial Conduct Authority in the conduct of investment business.

Board of directors

ICOF Ltd and Community Capital are managed by elected boards of non-executive directors who are appointed by the members at the Annual General Meeting. At present the boards of ICOF and Community Capital comprise the same people although this not a requirement.

Each year one third of the directors of each board retire from office to make way for an election. Directors receive no remuneration for their involvement.

The shareholders of ICO Fund plc have one representative on the board of ICOF Ltd.

Our Staff

Alain Demontoux, Operations and FCA Compliance Manager

Alain has been co-ordinating the head office for almost 20 years overseeing fthe administration of the lending, accounts, back-office and fund management functions and FCA compliance. Responsibilities also include shareholder liaison and the company secretariat. He has been involved in the co-operative sector for over 35 years, previously heading up finance at Essential Trading Co-operative, one of the largest independent distributors of natural and organic products in the UK.

Tim Coomer, Business Development Manager

Tim started with Co-operative & Community Finance in January 2016 having previously worked as a project manager and social enterprise adviser. He is responsible for promoting and raising the profile of the organisation, building partnerships and the development of finance packages with like-minded organisations that help to deliver social, environmental or community benefit.

Kevin Lloyd-Evans, Lending and Relationship Manager

Kevin has been with Co-operative & Community Finance since January 2022. He is responsible for lending across the UK to the co-operative and social enterprise sectors and for the maintenance of the lending portfolios. Kevin’s responsibilities include the assessment and management of financial risk and the development of new lending strategies.

Anne Wilks, Transactional Services Manager (Finance & Loan Portfolio)

Anne has been with Co-operative & Community Finance since October 2012. She first joined as Financial Co-ordinator and was promoted in 2018. As well as looking after the day-to-day banking, treasury, general ledger and payroll, Anne also manages all tasks related to Loan Portfolios (CCF & Back Office Clients) which includes legal documentation, disbursements, collections, monitoring, and reporting.

Key Documents

Annual Reviews

EDI & Equality Impact

EDI Action Plan

In line with the manifesto our EDI Action Plan centres around seven key themes:

- Commitment: Take ownership of our commitment to equity, equality, diversity, and inclusion.

- Collaborations: Build accountability through meaningful collaborations & co-production with networks and marginalised communities.

- Culture: Move beyond representation to work towards an inclusive culture.

- Open and transparent sharing: Accept the longevity and risk involved in meaningful pursuit of diversity and inclusion through open and transparent sharing.

- Equitable representation: Act with integrity through the investment of time, energy, and resources in equitable representation.

- Sustainable inclusion: Engage in intentional systems change and sustainable inclusion.

- Advocate: Advocate for diversity and inclusion & amplify marginalised voices.

Ethical policy

Co-op & Community Finance encourages local economic regeneration by enabling people to create, own and democratically control the businesses in which they work, or which operate in their local community.

Co-op & Community Finance funds are available to enterprises which practise or support principles of co-operation, common ownership, employee, community or social ownership, equal opportunity and workplace democracy, and sustainable development.

The Ethical Policy sets out the positive and negative criteria which guide the way in which Co-op & Community Finance carries out its business activities.

Positive criteria

As well as avoiding certain forms of business, we actively support businesses which benefit their employees, communities and environment. In particular, we will actively support the following:

- Co-operative enterprises (in all their forms) , community-owned enterprises/ businesses, credit unions, democratically controlled social enterprises and charities with trading subsidiaries.

- Promotion of co-operative values and principles: Co-op & Community Finance endorses and abides by the internationally recognised co-operative values and principles and expects that borrowers adhere to them as appropriate.

- Enterprises that promote Fair trade organisations and products.

- Enterprises promoting sound employment practices

- Enterprises with policies and procedures that encourage good principles of business behaviour and ethics.

- Enterprises providing solutions to climate change through the development, promotion and/or use of renewable energy and energy efficiency and the care of natural resources.

- Enterprises which promote recycling, sustainable waste management and reduction of single use plastics.

- Enterprises which contribute to supporting a healthy natural environment, preservation and restoration of ecosystems and biodiversity and help protect the natural world.

Negative criteria

The ethical policy seeks to ensure that Co-op and Community Finance avoids practice which it considers unethical. In particular we will not lend to, and will avoid general business dealings with, any organisations and enterprises:

- Involved with the production or sale of weapons.

- Which fail to uphold basic human rights within their sphere of influence.

- With connections with oppressive regimes or links with organisations that promote hate and/ or discrimination.

- Whose activity is linked to poor labour standards, unsafe practices, human rights violations, modern slavery or human trafficking.

- That takes an irresponsible approach to the payment of tax.

- Involved in the production of and/ or the marketing of products that are deemed harmful to health (e.g. tobacco products).

- Which uses products from unsustainable natural resources.

- Whose activity contributes to global climate change and/ or the destruction of ecosystems, biodiversity and the natural world.

- Whose activity is linked to unlawful or illegal practices or trade.

Application of the policy

Co-op & Community Finance applies its ethical policy when lending, making other investments and in its general business dealings. In particular we use the ethical policy criteria to assess:

- Core activities of organisations applying for loans.

- Companies in which Co-op & Community Finance invests or holds money.

- ICOF’s own business activities and operations.

Notes

Including good conditions of employment (job sharing, career breaks, maternity/paternity breaks), equal opportunities, health and safety, etc.

Human rights include labour practices that relate to human rights, such as non-discrimination, freedom of association/collective bargaining, child labour, forced and compulsory labour, disciplinary practices and indigenous rights.

Human rights also refer to those rights set out in the Universal Declaration of Human Rights, which are seen as the universal rights which every human being is entitled to enjoy and have protected. They include a broad range of basic rights including:

Political rights (e.g. right to asylum, right to take part in government).

Civil rights (e.g. right to life, liberty and security, freedom from slavery and torture, freedom of expression).

Economic rights (e.g. right to own property, right to work).

Cultural rights (e.g. right to education, right to participate in cultural life).

‘Oppressive regimes’ are those where basic human rights, as set out in the UN Declaration of Human Rights, are denied in a systematic manner over time. Links to an oppressive regime may include those businesses operating in states governed by oppressive regimes, whose activities are considered to support or benefit the regime, and businesses using state security forces or supplying arms to state security forces within an oppressive regime.

We also recognise the potential ethical issues with regards to the development and use of artificial intelligence and related technologies without appropriate governance and controls. We are committed to working with suitable partners to ensure that in the future the businesses and organisations we work with to do not conflict with our human rights and ethical commitments.