About us

Co-operative & Community Finance is the trading name of the ICOF family of businesses.

Industrial Common Ownership Finance Ltd (ICOF) was set up in 1973 and we have since created a number of related funds, all of which are democratically owned and controlled by the members. We provide sympathetic loan finance to help people take control of their economic lives and create social benefit.

We exclusively serve the co-operative and social enterprise sector, and for over 45 years we have supported hundreds of businesses ranging from small community‑run enterprises to large award‑winning organisations. Through the provision of accessible finance we have helped to create and preserve thousands of jobs within the social economy and supported the set up of many new and innovative co-operatives, employee buyouts, and community enterprises.

Our rates are competitive and unlike many high street lenders we don’t require personal guarantees.

We currently have over £4m of our own capital to lend, available to those that practise or support the principles of co‑operation, social ownership, and sustainable development. We also manage a number of other loan funds on behalf of other lenders.

Structure & governance

Structure and membership

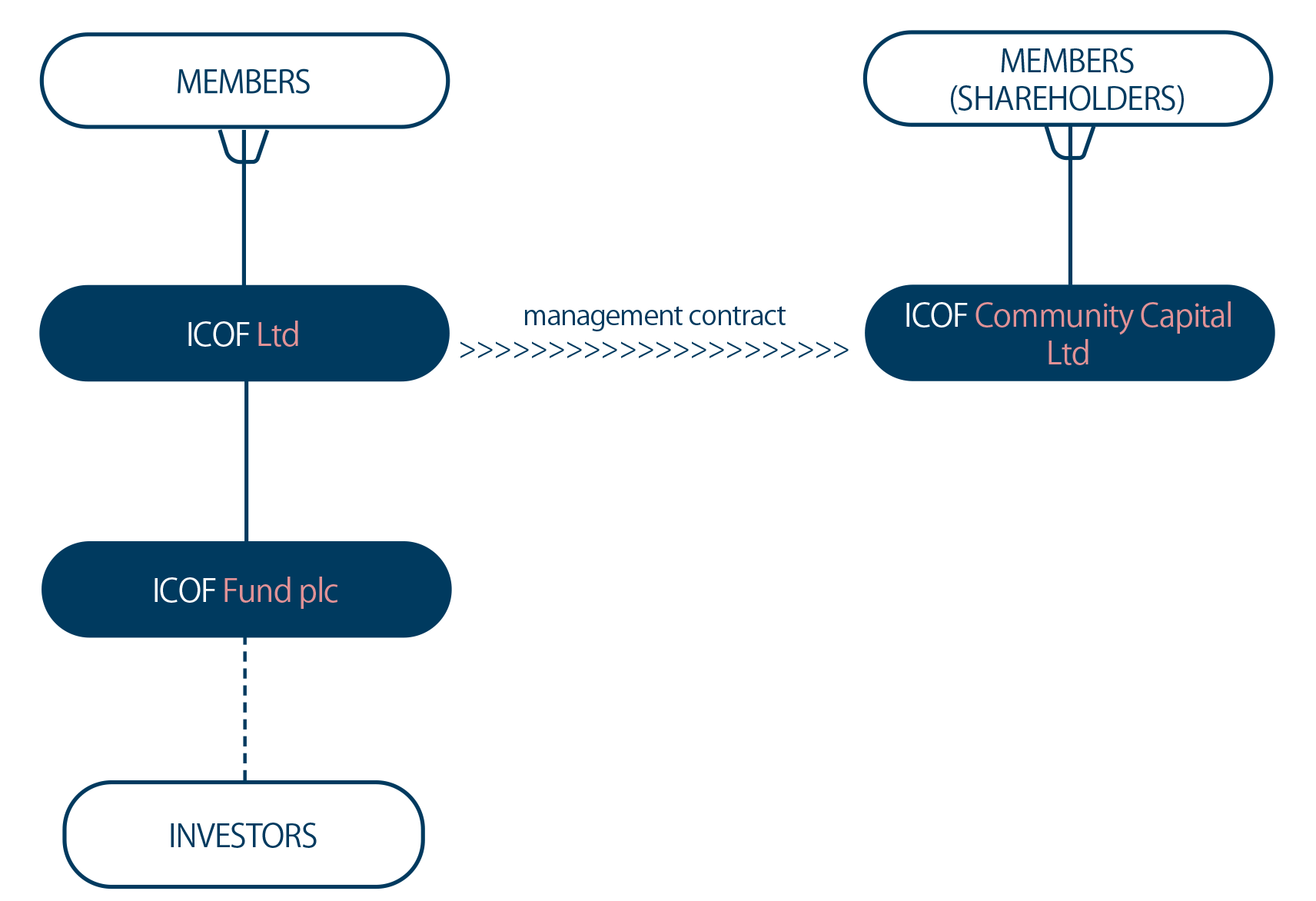

Co-operative & Community Finance is the trading name of ICOF Ltd which has a subsidiary, Industrial Common Ownership Fund plc (ICO Fund plc). ICOF Community Capital Ltd (Community Capital) is a free-standing community benefit society for which ICOF acts as fund manager.

Membership of ICOF Ltd is open to any individual or organisation who supports our aims and who pays a one-off membership fee (currently £30). All our borrowers automatically become members. Follow this link to apply for membership.

Membership of Community Capital is open to individuals or organisations who have bought shares in the society. The minimum investment is currently £250. Follow this link to invest in Community Capital.

Management and accountability

ICOF Ltd is the only one of the organisations to employ staff. ICOF Ltd directly manages the business of its subsidiary and is contracted to manage Community Capital. ICOF Ltd is able to do this because it is authorised and regulated by the Financial Conduct Authority in the conduct of investment business.

Board of directors

ICOF Ltd and Community Capital are managed by elected boards of non-executive directors who are appointed by the members at the Annual General Meeting. At present the boards of ICOF and Community Capital comprise the same people although this not a requirement.

Each year one third of the directors of each board retire from office to make way for an election. Directors receive no remuneration for their involvement.

The shareholders of ICO Fund plc have one representative on the board of ICOF Ltd.

Our Staff

Alain Demontoux, Operations and FCA Compliance Manager

Alain has been co-ordinating the head office for over 12 years looking after the administration of the lending, accounts, back-office and fund management functions and FCA compliance. He has been involved in the co-operative sector for over 30 years, previously heading up finance at Essential Trading Co-operative, one of the largest independent distributors of natural and organic products in the UK.

Tim Coomer, Business Development Manager

Tim started with Co-operative & Community Finance in January 2016 having previously worked as a project manager and social enterprise adviser. He is responsible for promoting and raising the profile of the organisation, building partnerships and the development of finance packages with like-minded organisations that help to deliver social, environmental or community benefit.

Kevin Lloyd-Evans, Lending and Relationship Manager

Kevin has been with Co-operative & Community Finance since January 2022. He is responsible for lending across the UK to the co-operative and social enterprise sectors and for the maintenance of the lending portfolios. Kevin’s responsibilities include the assessment and management of financial risk and the development of new lending strategies.

Anne Wilks, Transactional Services Manager (Finance & Loan Portfolio)

Anne has been with Co-operative & Community Finance since October 2012. She first joined as Financial Co-ordinator and was promoted in 2018. As well as looking after the day-to-day banking, treasury, general ledger and payroll, Anne also manages all tasks related to Loan Portfolios (CCF & Back Office Clients) which includes legal documentation, disbursements, collections, monitoring, and reporting.

Key Documents

Annual Reviews

EDI & Equality Impact

EDI Action Plan 2023 – 2024

We are proud to share our EDI Action Plan for 2023-2024. Produced by our Board and Staff team, this Plan includes specific commitments and objectives to help us move with purpose towards real, measurable, change. Explore it here.

October 2023: Update on our EDI journey

After a year on our Board, Trustee Owen Dowsett writes here on the progress we are making towards an equality agenda. He recognises progress made so far, identifies priority areas to work on, questions to ask and explores how our work sits within a wave of change across our the sector.

March 2023: Update to our EDI journey

Over the past year and across CCF, we have been working on our approach to Equality, Diversity and Inclusion (EDI). In April, our Board will receive a draft of our EDI Action Plan, which will be implemented in the spring. This is part of a broader commitment to understand what more we can do to promote diversity and equality, within the organisation, across the sector and more broadly, and to act on that. Our progress will be published on this page and will be updated regularly.

All those who participated in the various discussions throughout the year have been greatly appreciated, and we thank them for their continued support of CCF in finding a common path forward.

Key actions taken to date:

- The Diversity Forum manifesto was signed in April 2022. The Diversity Forum is a collective on a mission to drive inclusive social investment in the UK, through the convening of sector-wide groups, commissioning research, and knowledge sharing. Signing up to this showed our commitment to bringing about systemic change in support a more inclusive social sector.

- We are currently working on the development of our EDI Action Plan for 2023-24 that will fully align our commitments with those outlined in the Diversity Forum manifesto. The action plan will engage all members of our organisation and will be submitted to the Board of Directors for approval in April 2023.

- In order to help push forward our EDI action plan, the Board has established a formal EDI Sub-committee, whose role includes holding the company to account on EDI and related issues.

- EDI has become a regular topic of conversation at both Board and Staff meetings.

Our EDI Action Plan

In line with the manifesto our EDI Action Plan centres around seven key themes:

- Commitment: Take ownership of our commitment to equity, equality, diversity, and inclusion.

- Collaborations: Build accountability through meaningful collaborations & co-production with networks and marginalised communities.

- Culture: Move beyond representation to work towards an inclusive culture.

- Open and transparent sharing: Accept the longevity and risk involved in meaningful pursuit of diversity and inclusion through open and transparent sharing.

- Equitable representation: Act with integrity through the investment of time, energy, and resources in equitable representation.

- Sustainable inclusion: Engage in intentional systems change and sustainable inclusion.

- Advocate: Advocate for diversity and inclusion & amplify marginalised voices.

Ethical policy

Co-operative & Community Finance encourages local economic regeneration by enabling people to create, own and democratically control the businesses in which they work, or which operate in their local community.

Co-operative & Community Finance funds are available to enterprises which practise or support principles of co-operation, common ownership, employee, community or social ownership, equal opportunity and workplace democracy, and sustainable development.

The Ethical Policy sets out the positive and negative criteria which guide the way in which Co-operative & Community Finance carries out its business activities.

Positive criteria

As well as avoiding certain forms of business, we actively support businesses which benefit their employees, communities and environment. In particular, we will actively support the following:

- Co-operatives and community-owned enterprises: Development and promotion co-operatives, community-owned enterprises, credit unions and charities with trading subsidiaries.

- Promotion of co-operative values and principles: Co-operative & Community Finance endorses and abides by the internationally recognised co-operative values and principles and expects that borrowers adhere to them as appropriate.

- Social responsibility: Fair trade organisations and products.

- Companies promoting sound employment practices.

- Companies with policies and procedures that encourage good principles of business behaviour and ethics.

- Environment: Companies which provide solutions to climate change through the development, promotion and/or use of renewable energy and energy efficiency.

- Companies which promote recycling and sustainable waste management.

- Companies which operate good environmental practice.

Negative criteria

The ethical policy seeks to ensure that Co-operative and Community Finance avoids practice which it considers unethical. In particular we will not lend to, and will avoid general business dealings with, any organisations:

- Involved with the production or sale of weapons.

- Which fail to uphold basic human rights within their sphere of influence.

- With connections with oppressive regimes.

- Involved in the production of tobacco and tobacco products.

- Which have been convicted of serious environmental pollution.

- Which produce or distribute pornographic material.

- Which use timber from unsustainable sources.

- Which manufacture and/or distribute pesticide products which are harmful to the environment.

Application of the policy

Co-operative & Community Finance applies its ethical policy when lending, making other investments and in its general business dealings. In particular we use the ethical policy criteria to assess:

- Core activities of organisations applying for loans.

- Companies in which Co-operative & Community Finance invests or holds money.

- ICOF’s own business activities and operations.

Notes

Including good conditions of employment (job sharing, career breaks, maternity/paternity breaks), equal opportunities, health and safety, etc.

Human rights includes labour practices that relate to human rights, such as non-discrimination, freedom of association/collective bargaining, child labour, forced and compulsory labour, disciplinary practices and indigenous rights.

Human rights also refers to those rights set out in the Universal Declaration of Human Rights, which are seen as the universal rights which every human being is entitled to enjoy and have protected. They include a broad range of basic rights including:

Political rights (e.g right to asylum, right to take part in government).

Civil rights (e.g right to life, liberty and security, freedom from slavery and torture, freedom of expression).

Economic rights (e.g right to own property, right to work).

Cultural rights (e.g right to education, right to participate in cultural life).

‘Oppressive regimes’ are those where basic human rights, as set out in the UN Declaration of Human Rights, are denied in a systematic manner over time. Links to an oppressive regime may include those businesses operating in states governed by oppressive regimes, whose activities are considered to support or benefit the regime, and businesses using state security forces or supplying arms to state security forces within an oppressive regime.

Including publishing, printing distributing or selling pornographic newspapers, magazines, films or videos.